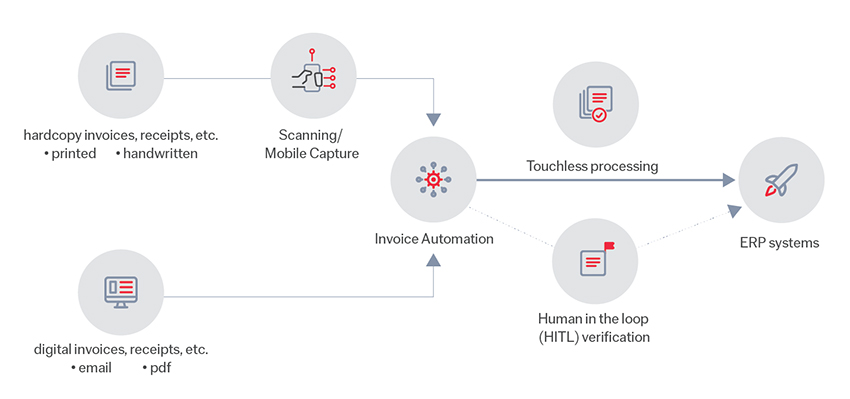

Invoice automation captures, extracts, and validates key data from invoices (both paper and digital) according to business rules. It then delivers the data to information systems such as RPA, BPM, and ERP to facilitate straight-through processing of invoices. No matter the channel that invoices arrive—paper, email, API, MFP/local scanning, mobile device, web-based scanning—all invoices are processed centrally.

Automated invoice processing uses OCR, AI, and ML to extract and process invoice data, streamlining and accelerating the invoice processing workflow.

Companies without automated systems will have to do the process manually, which means a member of staff physically typing data onto a computer, checking the details are correct, verifying the sums against an order, routing it for approval then payment, and keeping it stored and filed for future reference. All this can be extremely time-consuming and error prone.

Automated invoice processing aims to eliminate or minimize these manual processes by leveraging various technologies, such as optical character recognition (OCR), and intelligent document processing (IDP) for:

Invoice automation captures, extracts, and validates key data from invoices (both paper and digital) in accordance with a company’s rules. It then delivers the data to the company’s information systems such as RPA, BPM, and ERP to facilitate straight-through processing of invoices. No matter the channel that invoices arrive—paper, email, API, MFP/local scanning, mobile device, web-based scanning—all invoices are processed centrally. This is how it works:

1. Scanning and Data Extraction: Invoices received in physical or digital format are scanned or uploaded into the automated system. OCR technology is used to recognize and extract relevant information from the invoices, such as vendor details, invoice number, date, line items, and amounts. In a manual process this would mean an employee reading the paper and transferring the data by typing it onto the computer.

2. Data Validation: The extracted data is then validated against predefined rules and criteria. This helps to identify any discrepancies, errors, or inconsistencies in the invoice data.

3. Matching and Verification: The system can automatically match the invoice data with purchase orders to ensure that the goods or services have been received as expected. This means employees will no longer need to spend time cross-referencing documents to check details are correct.

4. Exception Handling: If any discrepancies or exceptions are detected during the validation and matching process, the system can flag these issues for further investigation and resolution. In the case of a manual process, the employee would need to have an eagle eye and concentrate hard to check for any nuances.

5. Workflow management: Automated workflows are designed to route the invoice through the appropriate approval process based on predefined rules and hierarchies. This can involve sending invoices to various departments or individuals for review and approval. Without automation, an employee may find themselves having to walk down the corridor to another department to find the person responsible for signing off the invoice.

6. Payment: Once the invoice has passed through the necessary validation steps and approvals, the system can trigger the payment process. This might involve generating payment instructions, updating accounting records, and initiating the actual payment to the vendor. Manually doing this process would take a lot of time, with an employee either writing a check, going to the bank, or making a digital payment by inputting the figures and details of the recipient online.

There are many ways that automation improves invoice processing. These include:

Automating invoice processing allows for a more streamlined workflow which eliminates unnecessary steps, reduces bottlenecks, increases performance, and minimizes wasted time. It also enables records to be centralized, which is important for accounts in terms of security, access, and efficiency.

Streamlining accounts also involves identifying and eliminating potential sources of errors, while standardizing processes ensures that tasks are carried out in a consistent manner. When workflows are optimized, decision-making becomes more straightforward and tasks completed faster, ultimately boosting productivity.

Humans can get tired and distracted when reading, inputting, or comparing data, which can lead to errors. Automating invoice processing takes away that problem as three-way matching brings accuracy, validation, improved performance, and consistency.

In three-way matching, the purchase order will be matched against goods received, then the purchase order will also be matched to the invoice for quantity and pricing. The automated system will also ensure further accuracy by matching the invoice against the goods received report. This three-way check helps organizations avoid overpayment, underpayment or incorrect payments while enhancing overall efficiency.

Invoice automation can save employees from having to perform manual data entry, freeing them to focus on higher value tasks. It also helps AP departments to avoid making late or duplicate payments.

Most companies see a 90% improvement in invoice processing times. Employee productivity increases by 400% and accounts staff spend 30% less time responding to queries. With straight through processing, invoices that used to take 1-2 days to process for payment, can now be completed in less than an hour.

Cost savings are always a major factor for switching to automated invoice processing. A good AP automation system will allow companies to benefit from 91% lower processing costs.

Recent surveys suggest that cross-industry, median AP cost/invoice is $11 while the best-in-class companies only spend $3 or less per invoice. With invoice automation, organizations also save money by being able to take advantage of early payment discounts.

Construction and engineering company Costain receives 400,000 invoices and was able to save nine minutes per invoice through undergoing digital transformation with ABBYY, bringing a significant amount of savings for the company.

Automation provides real-time tracking and reporting on the status of invoices. This visibility into the invoice lifecycle helps businesses keep track of outstanding payments, forecast expenses, and make more informed financial decisions.